Tariffs Explained: Market Volatility, Crypto Reactions, and Hawaii’s Economic Outlook

TL;DR: Key Takeaways

-

Tariffs cause immediate price hikes—but over time, inflation effects could outpace the one-time tariff bump, and cryptocurrencies may mirror or diverge from this trend depending on market sentiment and global risk perception.

-

Markets react quickly to trade policies—stocks and crypto both dropped after tariffs were announced but rebounded when they were paused.

-

Hawaii feels tariffs sharply—with its reliance on imports and tourism, the islands face higher living costs and economic risk.

Understanding Tariffs: A Clear Explanation

Tariffs are taxes imposed by governments on goods imported from other countries. Think of them as entry fees for foreign products, designed to protect domestic industries by making imported goods more expensive, thereby encouraging consumers to buy locally-produced items. While tariffs can safeguard local jobs and businesses, they typically result in higher consumer prices and can trigger trade disputes if affected countries respond with their own tariffs.

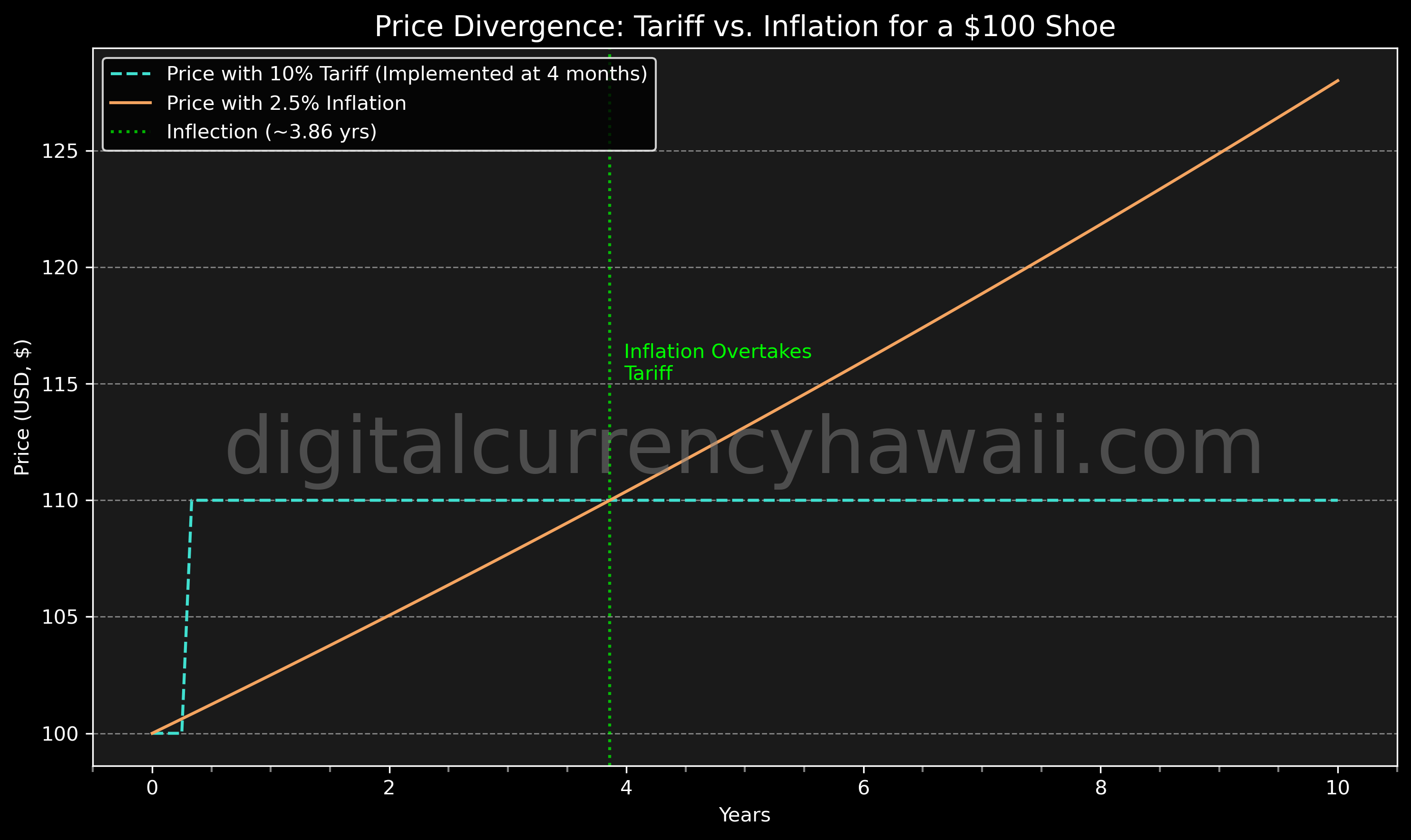

For example, consider a shoe that costs $100. If a government imposes a 10% tariff on imported shoes, the price immediately rises to $110. However, this price remains relatively stable unless the tariff rate changes. In contrast, if there’s a steady inflation rate of about 2% annually, the cost of the shoe increases incrementally over time, gradually becoming more expensive. This illustrates how tariffs can cause an immediate price jump, but that price typically remains fixed, unlike prices affected by ongoing inflation.

Why Tariffs Are Proposed and Their Intended Goals

Governments typically propose tariffs for several reasons:

-

Protecting Domestic Industries: Tariffs help domestic companies compete against cheaper foreign products by making imports pricier, thus preserving local jobs and industries.

-

Reducing Trade Deficits: By discouraging imports, tariffs aim to balance trade deficits, which occur when a country imports significantly more than it exports.

-

National Security: Tariffs can secure critical industries essential to national security (like steel and technology sectors) from foreign dependency.

-

Negotiation Leverage: Governments use tariffs strategically to gain leverage in international trade negotiations.

Recent U.S. tariff proposals under President Trump largely reflect these motivations, emphasizing protection of American manufacturing and reducing trade imbalances, especially with countries like China.

Evaluating the Effectiveness of Tariffs: An Evidence-Based Approach

While tariffs aim to support economic goals, their effectiveness is widely debated among economists:

-

Short-term Effectiveness: Evidence suggests tariffs effectively provide short-term protection for targeted industries, temporarily boosting domestic production and employment in protected sectors. However, immediate price increases for consumers are almost universally observed.

-

Long-term Outcomes: Long-term evidence is less favorable. Studies consistently show tariffs tend to distort market dynamics, leading to inefficiencies. Protected industries often become less competitive globally due to reduced incentives for innovation and efficiency.

-

Impact on Trade Deficits: Historical data indicates tariffs rarely achieve substantial reductions in trade deficits because overall consumption and demand patterns don’t drastically change. Additionally, retaliatory tariffs from trade partners often neutralize intended benefits.

-

Inflationary Pressures: Economically, tariffs typically act as inflationary measures, raising consumer prices directly and indirectly through supply chain disruptions. This effect is generally supported by empirical data on consumer price indices following tariff implementations.

Thus, while tariffs achieve short-term goals like industry protection and negotiation leverage, their effectiveness in sustainably resolving deeper economic issues such as trade deficits or fostering long-term economic health remains limited.

Linking Tariffs and Inflation: An In-Depth Look

Understanding the nuanced relationship between tariffs and inflation is important. While tariffs immediately raise prices, their long-term effects on inflation are complex and influenced by broader economic conditions.

If tariffs theoretically acted as anti-inflationary measures—perhaps by reducing consumer demand or boosting domestic production—the inflation rate might stabilize or decrease. However, current economic evidence generally shows tariffs as either inflationary or neutral, meaning they immediately raise prices without significantly slowing inflation over the long term.

This relationship is important for several reasons:

-

Consumer Impact: Tariffs instantly raise consumer prices, hitting wallets directly, especially in areas like Hawaii heavily reliant on imports. Inflation’s effects accumulate gradually, eventually surpassing initial tariff spikes and continuously increasing costs.

-

Policy Debate: The intersection point at which cumulative inflation overtakes tariff-induced price hikes illustrates that tariffs are not a long-term solution to inflation. Highlighting this intersection clarifies policy discussions by countering claims that tariffs permanently stabilize prices.

-

Visual Clarity: Visualizations clearly depict how tariffs create short-term price jumps while inflation gradually dominates longer-term economic impacts, effectively educating stakeholders on economic trends.

Short-term evidence strongly suggests tariffs increase inflationary pressure. Even assuming fixed tariffs, visual comparisons effectively highlight inflation’s enduring dominance.

Targeted Tariffs: Closing Strategic Loopholes

On April 2, 2025, President Trump introduced broad tariffs targeting multiple countries, notably China, Mexico, and Canada, and extended tariffs even to smaller jurisdictions, including territories with minimal or no permanent populations. The tariffs ranged significantly, with duties of up to 25% for Chinese imports, while other nations faced rates around 10–15%.

The inclusion of jurisdictions without permanent residents or significant economic activity was strategic, aiming to prevent companies from circumventing tariffs by rerouting products through tariff-free zones. This aligns with Trump’s negotiation philosophy from “The Art of the Deal,” emphasizing comprehensive and aggressive tactics to ensure maximum leverage in trade negotiations. However, this wide-reaching approach also risks escalating trade tensions and potential retaliation from even traditional allies.

Stock Market Volatility: A Rollercoaster Ride

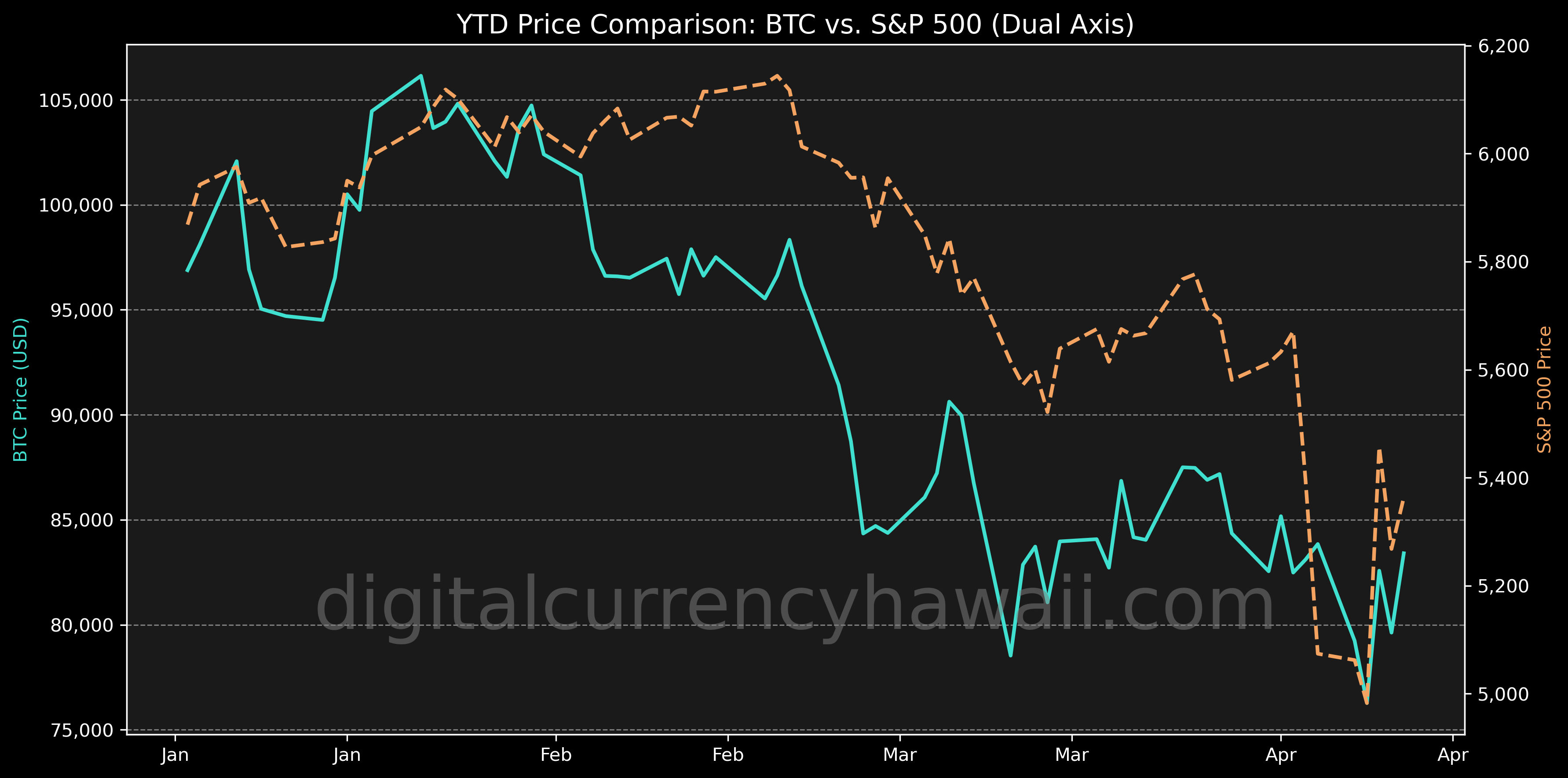

The tariff announcements immediately triggered severe stock market fluctuations. On April 3, 2025, the S&P 500 plummeted 5%, marking its worst single-day decline since June 2020 (The New York Times). Investors feared higher import costs would significantly impact companies dependent on global supply chains.

However, sentiment dramatically shifted on April 9, 2025, when President Trump scaled back tariffs to a universal 10% for most countries (AP News). The S&P 500 surged by 9.5%, illustrating markets’ sensitivity to trade policy developments.

Crypto Market Reactions: No Safe Haven Yet

Cryptocurrencies faced significant volatility during tariff turmoil. Bitcoin dropped below $78,000 by April 6, reflecting broader market fears (The New York Times). When tariffs eased, crypto rebounded alongside stocks (Fortune Crypto).

Why Crypto Mirrors Stocks Despite the Hype

Cryptocurrencies like Bitcoin were once hailed as a decoupled alternative to fiat currencies—a hedge against inflation and centralized economic instability. But in practice, crypto has increasingly mirrored the behavior of risk-on assets like tech stocks. Why? Institutional investors and hedge funds treat crypto as part of a high-risk, high-reward portfolio. When markets panic, they offload crypto alongside equities. Retail investors follow suit, reinforcing volatility. Rather than acting as a stable store of value, Bitcoin often amplifies broader market sentiment. This behavior undermines the narrative of crypto as a “digital gold,” particularly during global economic shocks like tariff announcements.

Bottom line, crypto is still largely tied to traditional market dynamics and should be viewed through that lens when assessing its role during economic uncertainty.). When tariffs eased, crypto rebounded alongside stocks (Fortune Crypto).

Hawaii’s Unique Economic Vulnerability

Hawaii’s economy faces particular risks from tariffs due to heavy reliance on tourism, imports, and agriculture. Increased tariffs could lead to higher prices for food, fuel, and construction materials (Hawaii News Now), potentially affecting tourism and agricultural exports.

Financial Market Ripple Effects

Tariffs also impacted Treasury yields and mortgage rates, signaling broader economic effects (FRED, Bankrate). (FRED, Bankrate).

Hawaii’s Economic Overview: Key Sectors at a Glance

| Sector | Impact of Tariffs |

|---|---|

| Cost of Living | Higher prices for imported goods, raising everyday costs for Hawaii residents. |

| Tourism | Risk of fewer visitors if global economic slowdown hits travel budgets. |

| Agriculture | Export challenges for coffee, nuts, etc., if retaliatory tariffs hit. |

| Construction | Rising lumber costs could drive up housing prices, hurting affordability. |

| Mortgage Rates | Rates up to 6.83% by April 9, 2025, making home loans costlier. |

Note: Impacts are estimates based on tariff announcements (April 2, 2025) and pauses (April 9, 2025), reflecting potential price increases and economic shifts. Mortgage rate data sourced from market reports.

Wrapping Up

The recent tariff actions of 2025 offer a powerful reminder of how global policy decisions can ripple through every layer of the economy—from Wall Street to local groceries in Hawaii. While tariffs may provide short-term strategic leverage and industry protection, their long-term impacts on consumer prices, market volatility, and global trade relations should not be underestimated.

Hawaii, uniquely vulnerable due to its dependence on imports and tourism, stands at the frontline of these effects. But the state also exemplifies resilience. With ongoing innovation in fintech and a strong sense of community, Hawaii can adapt and thrive—even in turbulent global markets. By understanding these dynamics and staying informed, we can better navigate economic shifts and advocate for smart, sustainable policy solutions.